Creating a living trust in Florida is an essential step for individuals seeking to protect their assets, streamline the inheritance process, and ensure their loved ones' financial security. Whether you're a resident of Florida or planning to establish a trust in the state, understanding the nuances of living trusts in Spanish can help you make informed decisions about your estate planning needs.

Living trusts, also known as "testamentos vivos," have become increasingly popular among Floridians due to their flexibility and effectiveness in managing assets during one's lifetime and after death. This guide will explore everything you need to know about living trusts in Florida, including their benefits, requirements, and how they differ from other estate planning tools.

By the end of this article, you'll gain a clear understanding of how to create a living trust in Florida and why it's crucial for safeguarding your assets and ensuring your wishes are honored. Let's dive in!

Read also:Discovering Shae Smoliks Age And Journey An Indepth Exploration

Table of Contents

- What is a Living Trust?

- Types of Living Trusts

- Benefits of a Living Trust

- Creating a Living Trust in Florida

- Legal Requirements for a Living Trust

- Funding the Trust

- Avoiding Common Mistakes

- Living Trust vs. Will

- Tax Implications of a Living Trust

- Conclusion

What is a Living Trust?

A living trust, or "testamento vivo" in Spanish, is a legal document that allows an individual to place their assets into a trust during their lifetime. The trust is managed by a trustee, who is responsible for ensuring the assets are distributed according to the grantor's wishes after their death. Unlike a will, which must go through probate, a living trust avoids this often lengthy and costly process.

Key Features of a Living Trust:

- Protects assets during the grantor's lifetime.

- Ensures smooth asset distribution after death.

- Avoids probate, saving time and money.

Living Trust Definition

In legal terms, a living trust is a fiduciary arrangement that allows an individual to manage their assets while they are alive and ensures their beneficiaries receive those assets after their passing. It is particularly beneficial for individuals with significant assets or those who wish to avoid probate proceedings.

Types of Living Trusts

There are two primary types of living trusts: revocable and irrevocable. Each type has its own advantages and is suited to different estate planning goals.

Revocable Living Trust

A revocable living trust allows the grantor to modify or revoke the trust at any time. This flexibility makes it a popular choice for individuals who want to retain control over their assets. However, assets in a revocable trust are still considered part of the grantor's estate for tax purposes.

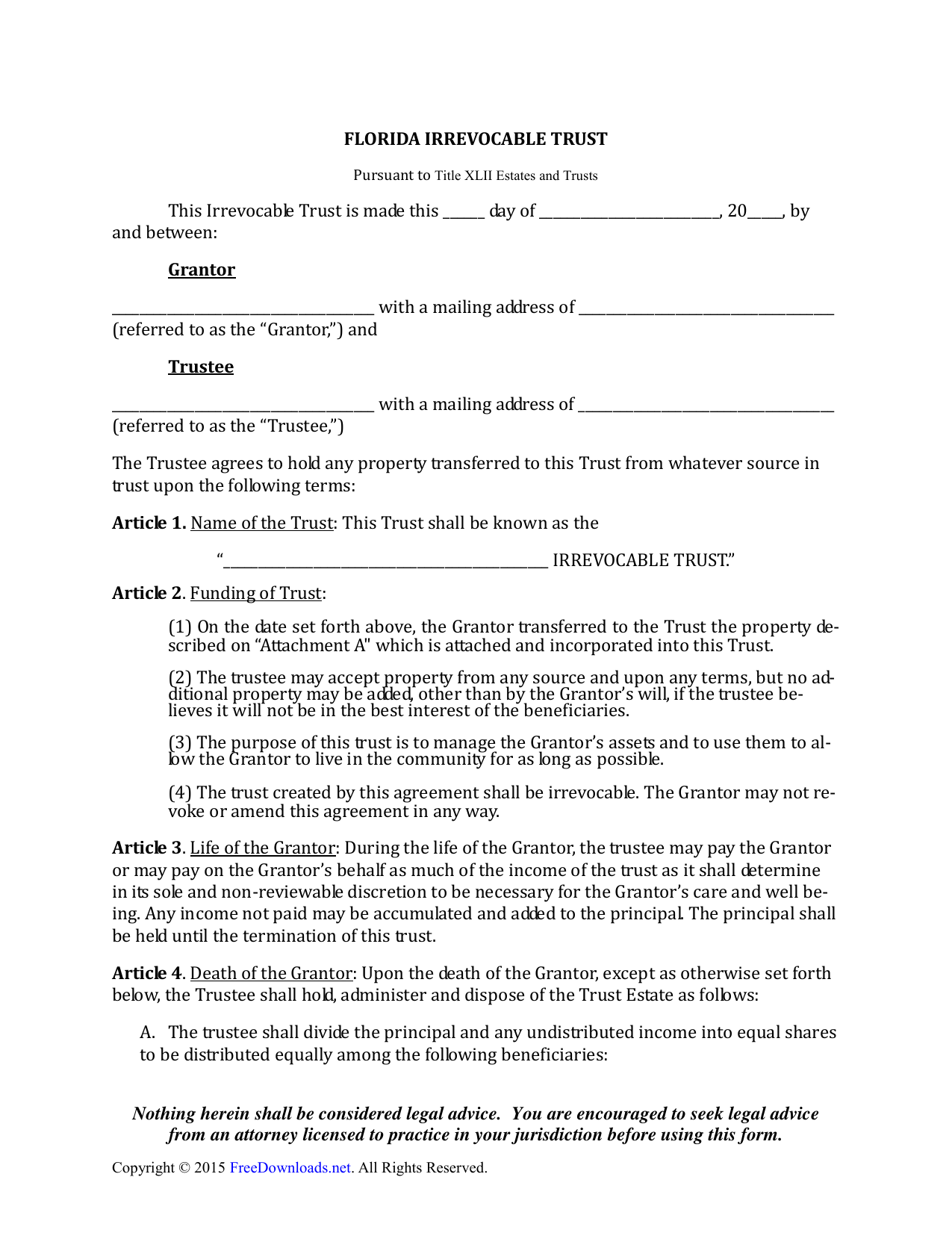

Irrevocable Living Trust

An irrevocable living trust, on the other hand, cannot be changed or revoked once it is established. This type of trust offers greater asset protection and potential tax benefits, as the assets are no longer considered part of the grantor's estate. However, the grantor relinquishes control over the assets once they are placed in the trust.

Read also:Jennifer Peterson Spouse Unveiling The Life And Love Of A Remarkable Woman

Benefits of a Living Trust

Establishing a living trust in Florida offers numerous advantages, including:

- Avoiding Probate: One of the primary benefits of a living trust is that it avoids the probate process, which can be time-consuming and expensive.

- Asset Protection: A living trust ensures that your assets are protected and managed according to your wishes, even if you become incapacitated.

- Privacy: Unlike a will, which becomes public record during probate, a living trust remains private, keeping your financial affairs confidential.

Creating a Living Trust in Florida

Creating a living trust in Florida involves several steps, including drafting the trust document, funding the trust, and appointing a trustee. Here's a step-by-step guide to help you get started:

Step-by-Step Process

1. Choose the Type of Trust: Decide whether you want a revocable or irrevocable living trust based on your estate planning goals.

2. Draft the Trust Document: Work with an experienced estate planning attorney to draft the trust document, ensuring it complies with Florida law.

3. Appoint a Trustee: Select a trustworthy individual or institution to serve as the trustee, responsible for managing the trust assets.

4. Fund the Trust: Transfer your assets, such as real estate, bank accounts, and investments, into the trust.

Legal Requirements for a Living Trust

In Florida, a living trust must meet certain legal requirements to be valid. These include:

- Written Document: The trust must be in writing and signed by the grantor.

- Notarization: The document must be notarized to ensure its authenticity.

- Witnesses: While not always required, having witnesses present when signing the document can strengthen its validity.

Funding the Trust

Funding a living trust involves transferring your assets into the trust's name. This step is crucial, as assets not properly funded into the trust may still be subject to probate. Common assets to include in a living trust are:

- Real estate properties

- Bank accounts

- Investment accounts

- Business interests

Avoiding Common Mistakes

When creating a living trust, it's important to avoid common pitfalls that could undermine its effectiveness. Some of these mistakes include:

- Not Funding the Trust: Failing to transfer assets into the trust can render it ineffective.

- Choosing the Wrong Trustee: Selecting an inexperienced or unreliable trustee can lead to mismanagement of assets.

- Ignoring Updates: Life changes, such as marriage, divorce, or the birth of a child, may require updates to the trust document.

Living Trust vs. Will

While both living trusts and wills are essential estate planning tools, they serve different purposes. A living trust allows for the management and distribution of assets during and after the grantor's lifetime, while a will only comes into effect after death. Key differences include:

Comparison Table

| Feature | Living Trust | Will |

|---|---|---|

| Avoids Probate | Yes | No |

| Privacy | Private | Public Record |

| Asset Management | During and After Lifetime | After Death Only |

Tax Implications of a Living Trust

Understanding the tax implications of a living trust is crucial for effective estate planning. While a revocable living trust does not offer tax benefits, an irrevocable living trust can provide significant tax advantages by removing assets from the grantor's estate. Consult with a tax professional to determine the best approach for your situation.

Conclusion

Creating a living trust in Florida is a powerful tool for protecting your assets, ensuring smooth asset distribution, and avoiding probate. By understanding the different types of living trusts, their benefits, and the legal requirements, you can make informed decisions about your estate planning needs.

We encourage you to take action by consulting with an experienced estate planning attorney to draft your living trust. Share this article with friends and family who may benefit from learning about living trusts, and feel free to leave a comment below if you have any questions or feedback.

Remember, planning for the future is an investment in peace of mind for you and your loved ones. Start building your legacy today!