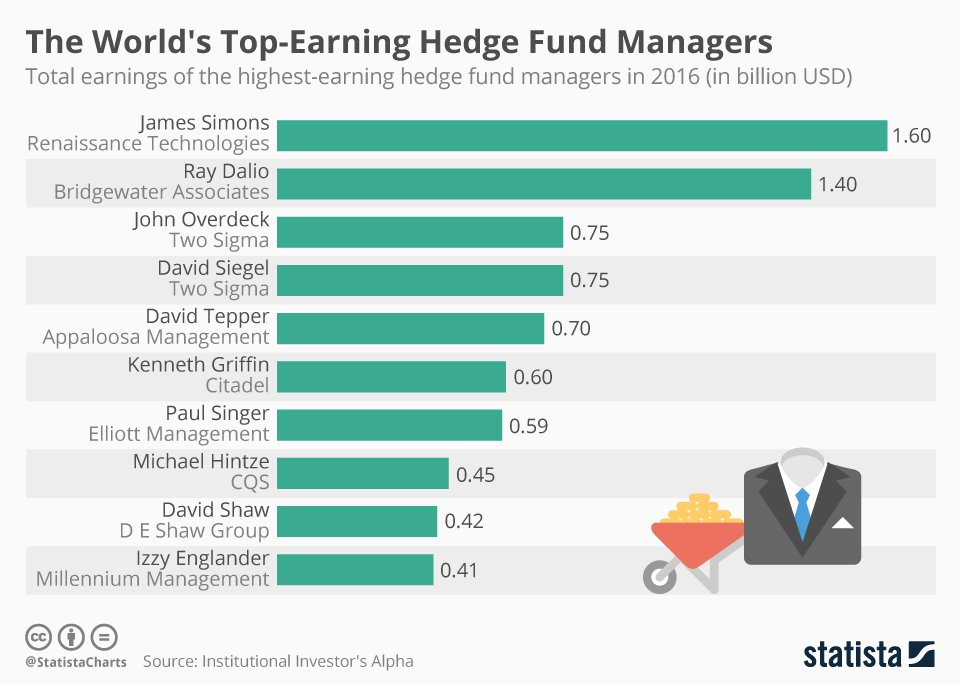

Alright, let's dive into the incredible story of a young man named James Levin, a 31-year-old hedge fund trader who earned $300 million in a single year. According to the Bureau of Labor Statistics, the average college-educated 31-year-old with a full-time job earned between $50,000 and $65,000 in 2013. Did you make more or less than that last year? If you beat the national average, give yourself a big pat on the back. I mean, seriously, you rock! Now, let me tell you something: I happen to be a 31-year-old college-educated person, and I'll admit it—I beat the average last year. Woo hoo! I rock! But before we get too caught up in our own achievements, let’s talk about someone who might make us reconsider what "success" really looks like.

Introducing James Levin: The Wall Street Wizard

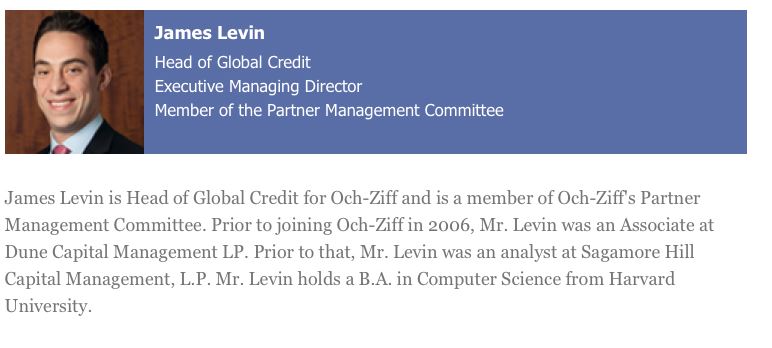

James Levin is no ordinary trader. He's a managing director for a New York City-based hedge fund called Och-Ziff Capital Management Group. In 2013, James had a year that might just go down as the most impressive in financial history. Now, I don't say that lightly. Let me explain why. Och-Ziff Capital Management Group was founded in 1994 by seasoned Wall Street veteran Daniel Och. Och started the fund with a big investment from members of the wealthy Ziff family, hence the name Och-Ziff. As of January 2014, Och-Ziff managed an impressive $40.6 billion in assets. It became a publicly traded company in 2007 and today boasts a market cap of $5.6 billion.

Read also:Diane Hovenkamp A Detailed Look Into Her Inspiring Journey And Achievements

From Harvard to Wall Street: The Rise of James Levin

James Levin, or as his friends call him, Jimmy, graduated from Harvard in 2005 with a degree in computer science. He quickly transitioned into the world of finance, working at firms like Dune Capital and Sagamore Hill Capital Management. In 2006, he joined Och-Ziff, where he began his meteoric rise. Here's the kicker: Jimmy wasn't just any hire. He had been family friends with Daniel Och for years. They met when Jimmy taught Och's son how to water ski at a summer camp. Imagine that—making a connection like that while working a minimum wage summer job. Not bad at all!

Jimmy's Journey to the Top

Between 2006 and 2012, Jimmy climbed the ranks at Och-Ziff with incredible speed. By the time he was just 29 years old in 2012, he was managing a 14-person team and overseeing billions of dollars. After turning 30, he was promoted to the firm’s executive team and took over the entire global credit investing desk. Think about that for a second—global credit investing desk! And remember, this is a company with nearly 500 employees. Impressive, right?

The Big Bet That Paid Off

In 2012, Jimmy made a bold recommendation. He suggested that the firm purchase $7.5 billion worth of "structured credit instruments." These are loans with fixed payment schedules, which can include credit card debt, mortgage debt, or government debt. While we don't know exactly what type of debt Jimmy purchased, it's safe to assume it involved mortgages. Banks were eager to sell these loans at pennies on the dollar, and as the economy recovered between 2012 and 2013, not only did the investment earn returns from timely mortgage payments, but its overall value skyrocketed.

By the time the investment was fully unloaded in 2013, the firm had earned a staggering $2 billion profit. To put that into perspective, in 2013, the entire firm earned $3.4 billion, meaning this one trade accounted for nearly 60% of all their profits that year. Now, hedge funds are usually extremely secretive about their earnings and employee compensation. However, since Och-Ziff is publicly traded, they are legally required to report unusually high salaries and bonuses to the Securities and Exchange Commission (SEC). And guess what? Jimmy’s compensation definitely warranted an SEC disclosure.

Read also:Bridget White Age Discovering The Life And Legacy Of A Remarkable Woman

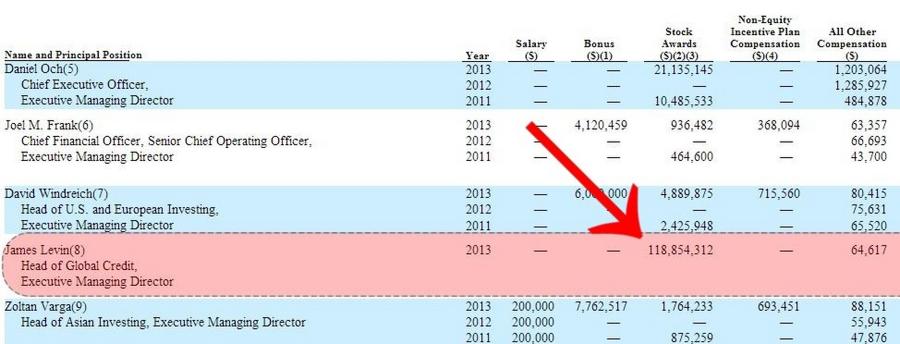

The $118 Million Bonus

Take a look at the highlighted pink section in the actual SEC filing below. If you go from left to right next to "James Levin," you'll see Och-Ziff paid Jimmy zero dollars in salary and zero dollars in cash bonuses for 2013. Now, move one column to the right. See where it says "Stock Awards"? This column lists any stock grants given out. As you can see, last year Och-Ziff gave James Levin $118,854,312 worth of stock. Yes, you read that right—Jimmy's bonus for 2013 was $118.8 million. And he’s only 31 years old! To put that into context, Och-Ziff CEO Daniel Och only made $22 million last year. Jimmy’s bonus is more than the combined salaries and bonuses of the CEOs of JP Morgan, Bank of America, Goldman Sachs, Morgan Stanley, Citibank, and Wells Fargo.

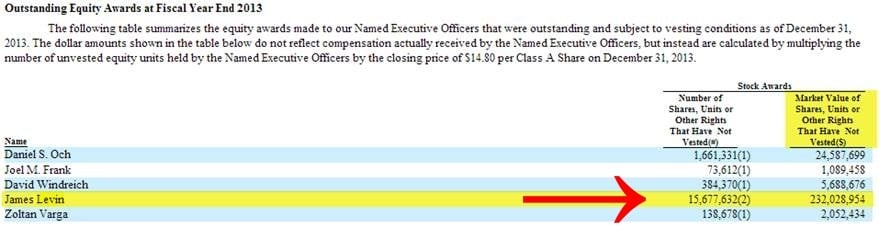

The Additional $184 Million

If you keep scrolling through the SEC filing, you'll find a section titled "Outstanding Equity Awards at Fiscal Year End 2013." Here, Och-Ziff is required to list any additional shares of stock given to executive officers as incentives. These shares typically vest over a 10-year period, meaning 10% become sellable every year. In this section, you'll see that Jimmy was also given 15.6 million unvested incentive shares in Och-Ziff. In December 2013, when those shares were filed with the SEC, they had a market value of $232 million. At today's market price, those 15.6 million shares are worth $184 million.

The Total Compensation: $302 Million

That brings Jimmy's total potential compensation for the year 2013 to $302 million. It was actually closer to $350 million back in December when Och-Ziff shares were slightly higher. Take a minute to let that sink in. Now, keep in mind, those 15.6 million shares won't be sellable for many more years. Jimmy could choose to stick around at Och-Ziff and wait for all his money to roll in, but that might get boring. If he decided to leave, he'd need to find a firm willing to compensate him for the money he'd be leaving on the table. While $10 million or even $30 million might be manageable for a rival firm, $200 million is a different story.

Why Stock Over Cash?

Notice how Jimmy opted to take all his current and future compensation in the form of stock instead of cash? There's a very strategic reason for that: taxes. If you knew you were owed a huge bonus and your company was publicly traded, it would be smart to request stock instead of cash upfront. This could lead to significant tax savings. When looking at the $118 million he was granted, assuming Jimmy waits more than a year to sell his shares, he'll be able to pay the long-term capital gains tax rate (20%) instead of the short-term rate (39.9%). In terms of federal taxes, that represents roughly $24 million in savings. He could do the same with his 15.6 million deferred shares, but by delaying the sale, he’s exposed to fluctuations in the stock price. Of course, the stock could also go up, which would be a double win.

Final Thoughts

It's simply incredible. I don't really know what else to say. What would you do if you made $300 million as a 31-year-old? If you were Jimmy, would you wait around for 10 years to earn the full amount, or would you call it quits and retire to a beach in the Bahamas? Let me know in the comments below. And hey, if you ever meet James Levin, make sure to shake his hand. That's one heck of an accomplishment!